owner draw quickbooks s-corp

Owner draw quickbooks s-corp. Create a personal Other Asset account.

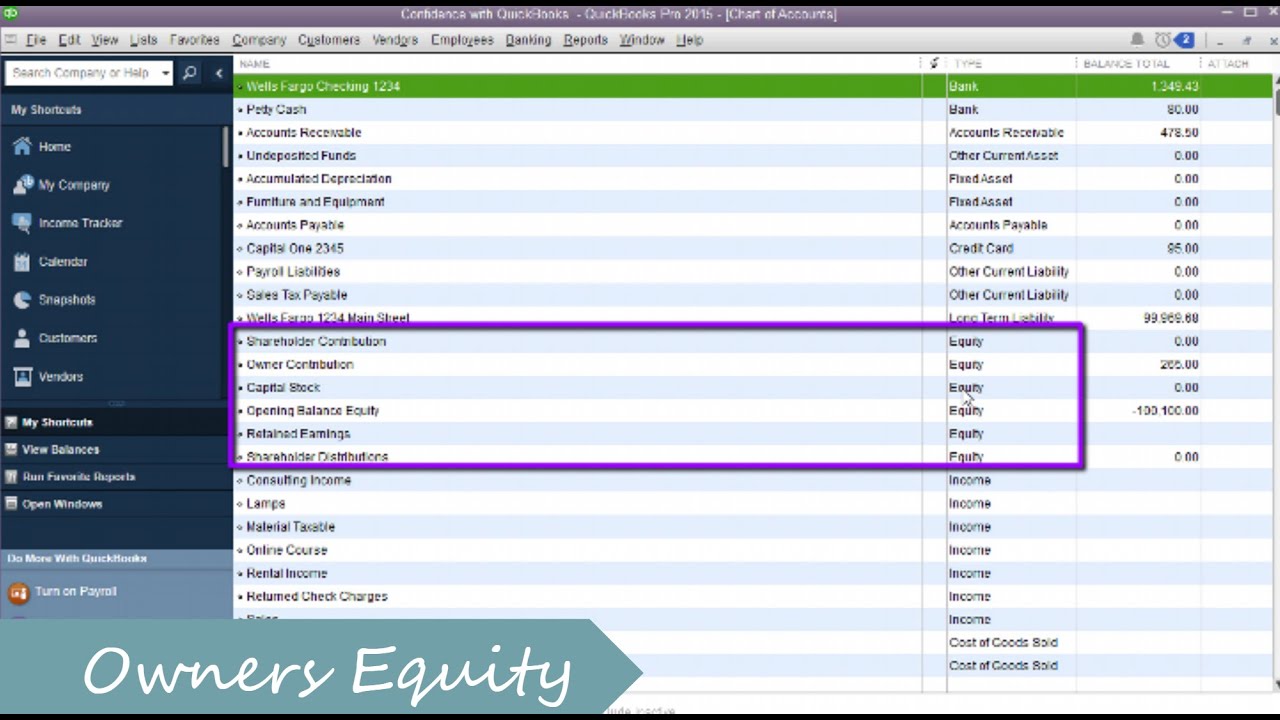

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

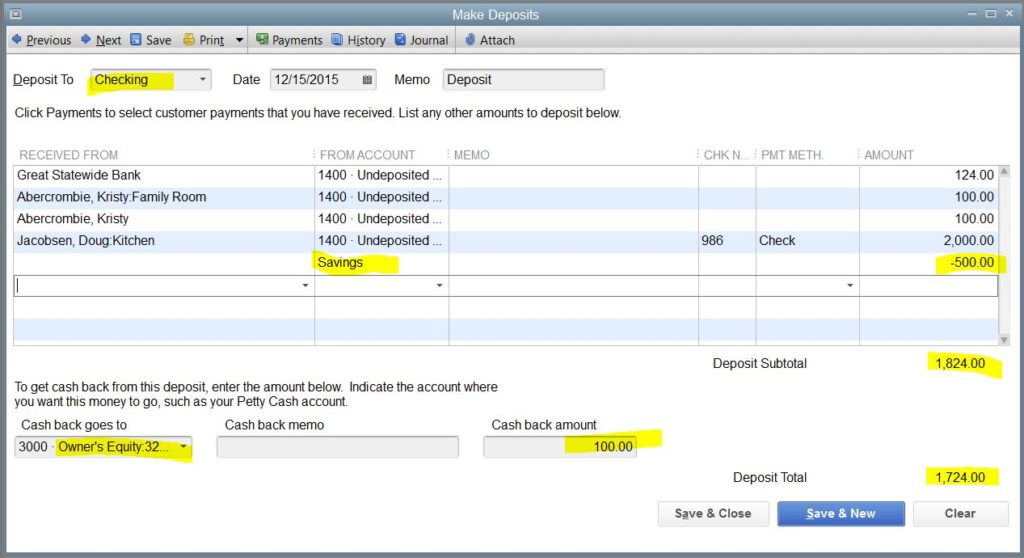

The business owner takes funds out of the business for personal use.

. Open the QuickBooks Online application and click on the Gear sign. To delete the expense transaction simply open it click the More menu then select Delete. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

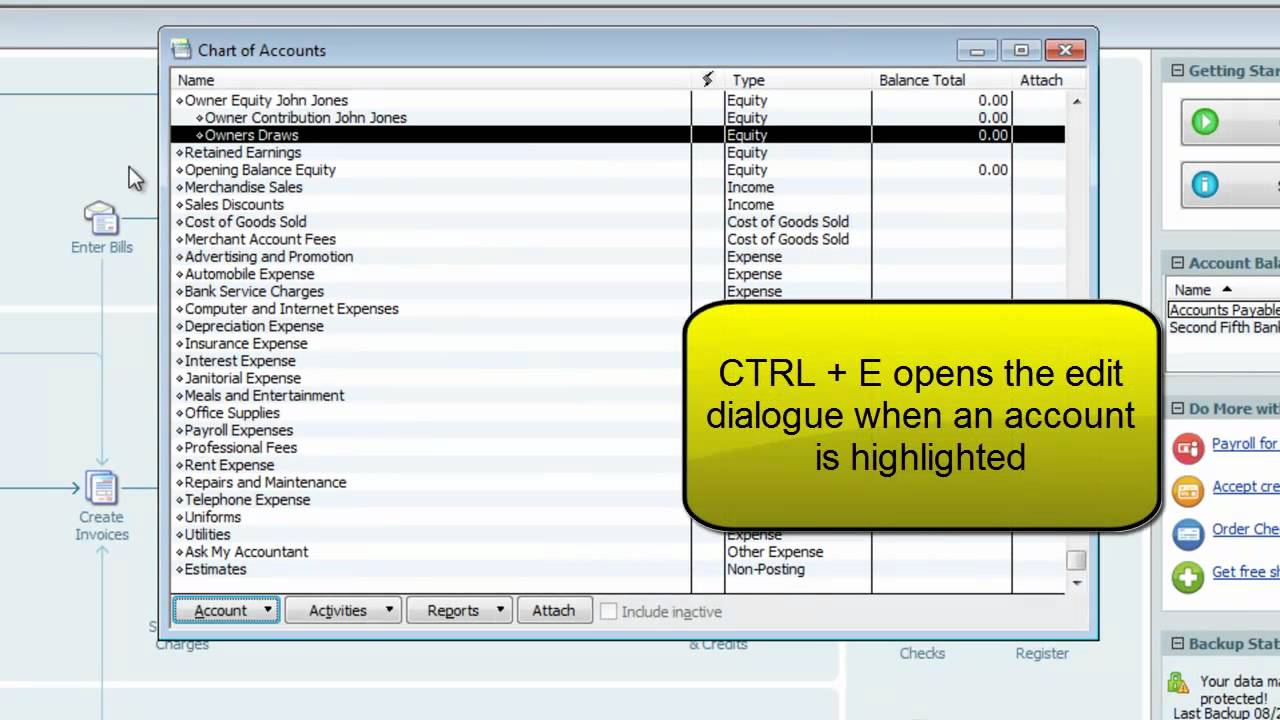

Visit the Lists option from the main menu. The owner of a single-member LLC withdraws money by taking an owners drawwriting themselves a business check or if their bank allows it transferring money from. Now hit on the Chart of.

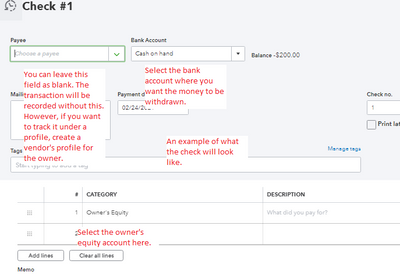

The account to charge. Here are some steps. Next process the draw through a check.

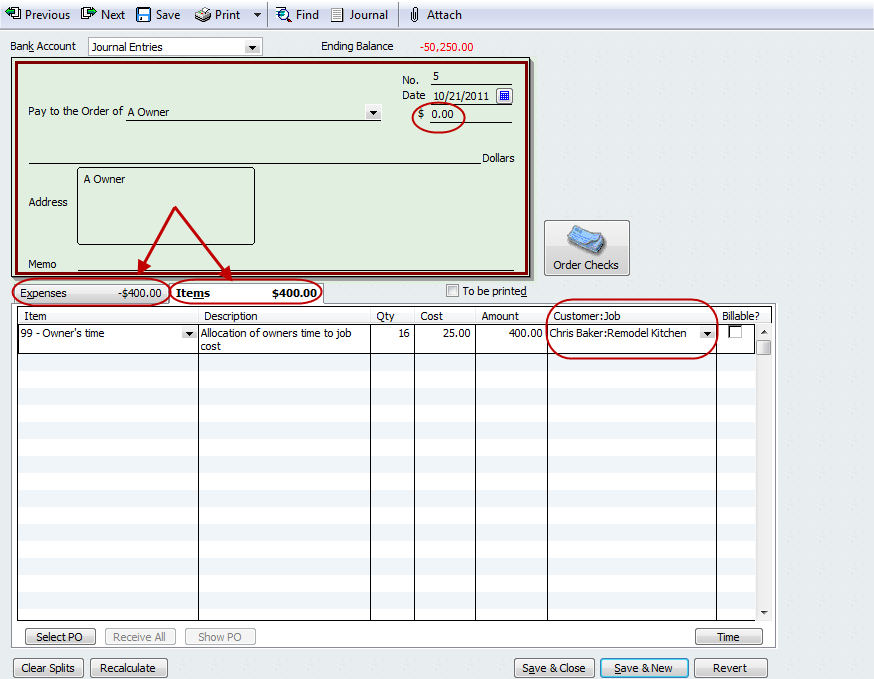

Then choose the option Write Checks. Owners draws can be scheduled at regular intervals or taken only. At the upper side of the page you need to.

If you have QuickBooks record this payment the same way you would a regular check as if you were paying bills. In QuickBooks Desktop software. Setting Up an Owners Draw.

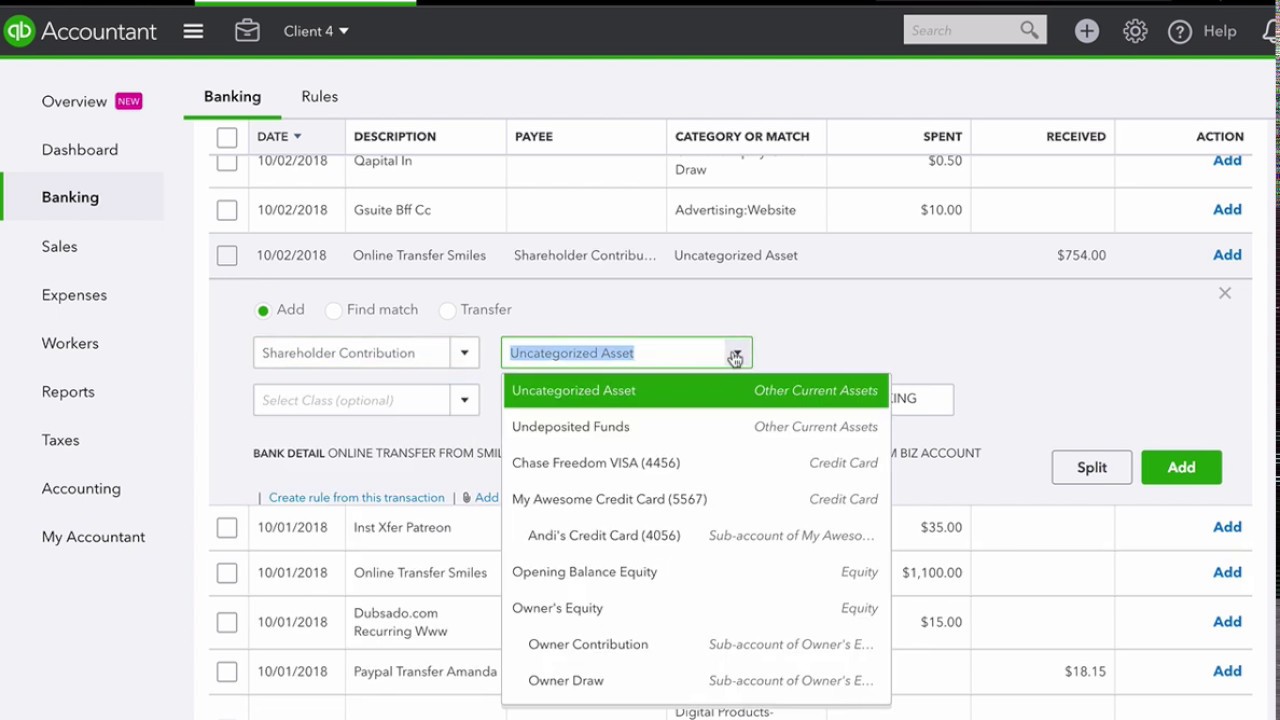

Click the New button. Here are few steps given to set up the owners draw in QuickBooks Online. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

Click on the Banking menu option. Heres the work around Im using. In addition there is the possibility that a distribution can be taxable if it exceeds the AAA accumulated adjustments account and there is EP earnings and profits.

You may find it on the left side of the page. Make the check payable to you. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each.

I named mine Businesses - MY BUSINESS NAME with my actual business name of course. Navigate to Accounting Menu to get to the chart of accounts page. To Write A Check From An Owners Draw Account the steps are as follows.

Paying yourself in an s corp the irs requires that all s corp owners also known as shareholders who are actively involved in running the. Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Quickbooks Owner Draws Contributions Youtube

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Solved S Corp Officer Compensation How To Enter Owner Eq

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Benefits Of Owning An S Corp Taking Distributions

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

Owners Draw Setup Quickbooks Create Setting Up Owner S Draw Account Qb

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

Solved S Corp Officer Compensation How To Enter Owner Eq

Learn How To Record Owner Investment In Quickbooks Easily

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

How Do You Pay Yourself As The Owner Of The Business Bookkeeping Network

I Need Help With Owners Equity Entry

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube

How Can I Pay Owner Distributions Electronically

Solved S Corp Officer Compensation How To Enter Owner Eq